If your hands are itching to get on some active online trading, well, you need a trading platform that perfectly fits you. As a trader, you are looking for apps that optimize for low costs, but include solid research and analytical tools.

If your hands are itching to get on some active online trading, well, you need a trading platform that perfectly fits you. As a trader, you are looking for apps that optimize for low costs, but include solid research and analytical tools.

But ideally, what’s a trading platform?

To trade, you need a broker that matches your needs. A broker allows you to buy and sell assets. But to do this anywhere you are, you need a software tool that enables you to execute and manage various market positions of your asset via the internet. That is what we call a trading platform.

Some commonly traded assets include currencies, stocks, bonds, futures, and options, just to name a few.

Online trading comes with lots of unique benefits, but not without some negative aspects as well. So, before we look into some of the best trading platforms, we pitch the rewards of trading online against its limitations to allow you to decide if it’s the best investment strategy for you.

Contents

How Trading Platforms Work

Trading software monitors markets and allows investors and traders to take a position through the execution of various commands. Thus, they come loaded with other features like real-time quotes, charting tools, news feeds, and market analysis. Some platforms, though, tailor-made for specific markets. They may be purely dealing with stocks, currencies, bonds, options, or futures. But others integrate all markets.

To understand how trading platforms work, we need to classify them into two: prop and commercial platforms.

Prop Platforms Vs. Commercial Platforms

Props platforms are developed by brokerage firms, while commercial platforms are done by independent trading software development companies. Here is a brief overview of each type.

a) Prop platforms

Prop platforms are linked to a specific broker and only provide services related to that firm. When you use such an app, you can’t switch between from one broker to another. To do that, you’ll have to get another software.

Remember, these apps by brokers are primarily intended to make it easier for their customers to trade. But truth be told, to brokers, these apps are mere tools to retain customers and earn commissions. So, the apps may not include lots of resources or may not be customized well enough.

It is, however, not to say they are of poor quality. Some of them are excellent, but they are best for high-end traders who already have a working relationship with the respective broker.

b) Commercial Platforms

These platforms focus on the trader, and thus, generally are user friendly and look a lot better than their props counterparts. Nonetheless, they miss one thing –broker customization.

Since their designers of these platforms create them for commercial purposes, you may find a few, which feature-wise, are skewed towards some brokers.

They, however, stand out for their user-friendliness and ability to allow you to move from one broker to another broker within the app quickly. Their assortment of helpful features includes investor education and research materials like news feeds and charts.

A trader will choose a trading platform depending on their trading style and volume, plus a host of other factors.

Pros and Cons for Online Trading

Pros:

- Set your preferred work hours, regardless of your location.

- Low fees for trades

- Monitor investment in real-time.

Cons:

- Risk of poor investments choices

- It’s as addictive as video games and gambling

- You can lose out on trades due to latency or internet connection loss.

Note: Day trading is neither illegal nor unethical, but it is a skillful art. Many naïve day traders who jump into buying and selling securities with the hope of quickly getting rich, end up in debts and deep financial troubles.

Top Trading Platforms You Should Consider

Here are some of the most popular trading platforms:

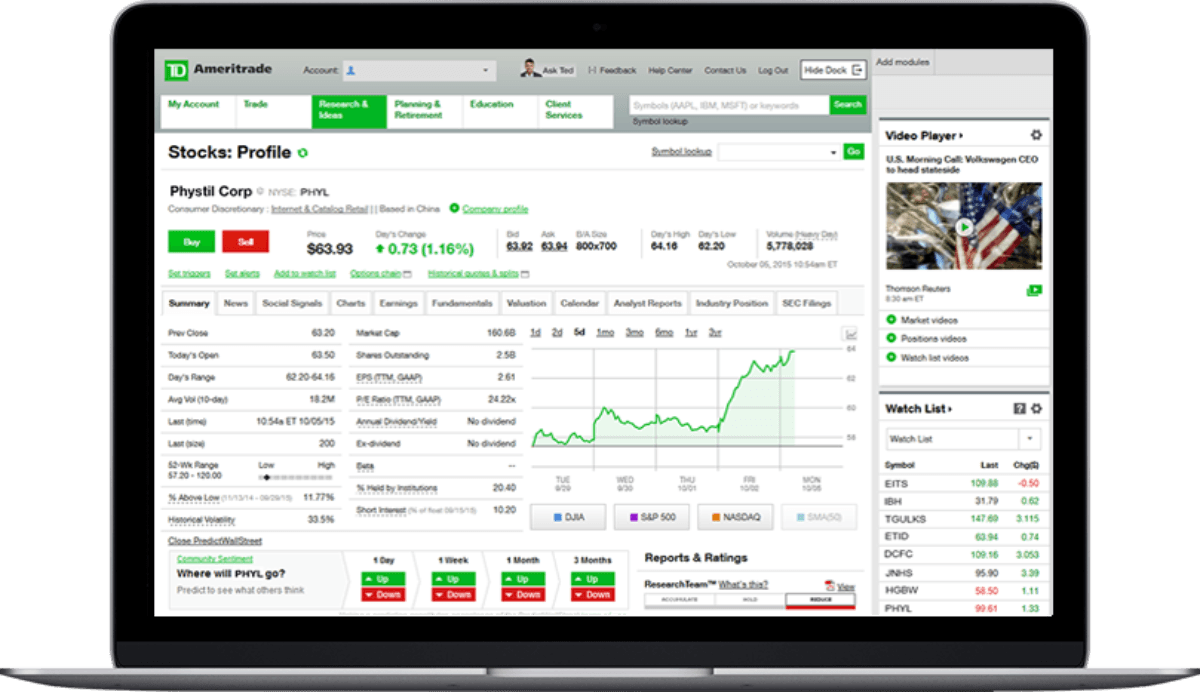

1. TD Ameritrade – Best Overall trading platform

TD Ameritrade is a broker portal that allows you to trade on assets, including stocks, forex, futures, options, and futures. Besides trade, you get access to research materials, charting tools, trading simulator, and much more.

What’s more, the TD Ameritrade no longer charges any commissions and requires no minimum balance for stock, ETFs, and options trades. Also, you have access to four trading platforms with their trading tools.

Perhaps the broker is going to change how it does business, given that Charles Schwab has already acquired it, and arrangements are underway to integrate the two platforms. But until then, TD Ameritrade continues to lead while others follow. The good news is it still accepts new accounts.

TD Ameritrade has embraced technology, integrating AI in its Alexa Skill, and is available for both AppleCar and Android Auto.

Through its thinkorswim platform, you have access to elite-level trading tools backed by insights, a dedicated trade desk, and educational pieces. You can customize your trade using powerful trading tools designed to help you implement even the most complex strategies.

When it comes to mobile trading, no platform outwits TD Ameritrade. The powerful mobile app provides both traders and investors with the ability to manage investments, exploit opportunities, among other things. What’s more, the apps are optimized for different hand devices, including smartphones, tablets, and now even Apple Watch.

Its customer support is incredible. You can get help online or at any of its over 275 branches across the country.

Pros and Cons

Pros

- Commission-free stock, ETF, and options trades.

- Access to four high-quality trading platforms.

- Large investment selection.

Cons

- Costly broker-assisted trades.

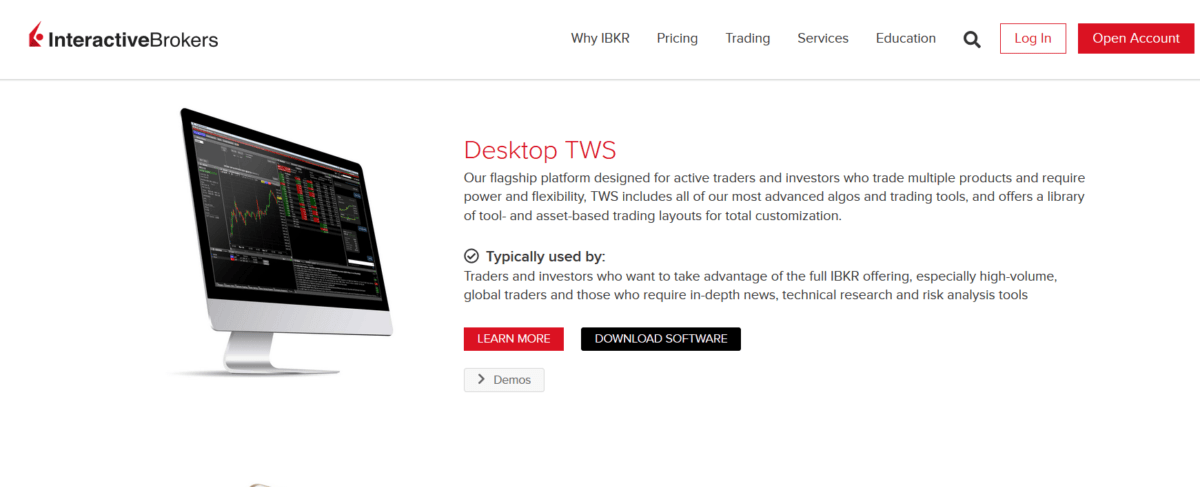

2. Interactive Brokers (IBKR) – Best for High Volume

Interactive Brokers lets you access over 125 markets in 31 countries, with a staggering 65 different order types. Though it is not the best option for casual traders, it provides the cheapest trading services for huge trades.

Interactive Brokers lets you access over 125 markets in 31 countries, with a staggering 65 different order types. Though it is not the best option for casual traders, it provides the cheapest trading services for huge trades.

Its Trader Workstation (TWS) platform provides excellent tools like charting and streaming of news. It is the ideal platform for you if you’re placing huge trades since it offers discounts of up to 90 percent on its base commissions.

And with every broker dropping their fees, the company, too, launched its free version – IBKR Lite. The platform offers unlimited, commission-free trades on US stocks and ETFs, with neither account minimums nor inactivity fees.

As though that is not enough, IBKR Lite pays you a competitive interest on your cash balances. Also, earn side income in the company’s Stock Yield Enhancement Program and low financing rates, in case you borrow against your account.

List of assets provided by Interactive Brokers include:

- Stocks

- Options

- Futures

- Forex

- Bonds

- ETFs

All these are available from a single integrated account.

When it comes to the utilization of technology, IBKR’s powerful suite enhances your trading speed, which improves the efficiency to carry out sophisticated portfolio analysis.

On the flip side, while it has put in a lot of effort to improve its website and services for casual investors, it still scores poorly as an option for beginners.

Pros and Cons

Pros

- Research highlights include several screeners and extensive back-testing functionalities.

- Has dozens of third-party provider feeds a la carte, like Morningstar, available at a monthly fee.

- Any package purchased integrates TWS.

Cons

- Complicated research processing even for basic searches.

- No streamlined views, you need to learn how to navigate TWS

3. TradeStation – Best for options

TradeStation is a trading technology trendsetter that supports both casual and active traders. It offers flexible and convenient pricing plans and has a fantastic award-winning desktop platform. We picked it as the best platform for anyone out for a variety of assets.

TradeStation is a trading technology trendsetter that supports both casual and active traders. It offers flexible and convenient pricing plans and has a fantastic award-winning desktop platform. We picked it as the best platform for anyone out for a variety of assets.

You can place trades using keyboard shortcuts, tickets, even a graph as the data stream in real-time. Your order is routed to reflect the prevailing market price. By exploiting its OptionStation Pro, you enjoy access to the flexible toolset that makes it seamless to analyze and place options trades.

For those traders who want to learn, TradeStation has a YouTube channel with updated informative video content

As for costs, TradeStation’s base commission is $0 for stocks and ETFs trades of the first 10,000 shares per trade. The commission on options, too, is $0.

TradeStation powerful desktop platform allows you to customize technical indicators to ones that suit you. You can also take advantage of the OptionsStation Pro to visualize the potential payoffs.

While TradeStation scores well in futures, options, and mobile trading both for professional and day trading. There is a lot to like, particularly TS Select and TS Go accounts. Even so, it falls short in research tools for casual investors.

Pros and Cons

Pros

- Excellent web and mobile trading platform.

- Commission-free stocks, ETFs, and options trades.

- High-quality educational tools

Cons

- Poor customer service

- No forex trading

- Unfriendly deposit and withdrawal options

4. E-Trade – Best for Beginners

E-Trade is an all-rounded trading platform, with everything beginners and professional traders need. Let’s break it down for you.

E-Trade is an all-rounded trading platform, with everything beginners and professional traders need. Let’s break it down for you.

Have you heard about the rules of threes? Well, it says good things come in threes. Just the same way, E-Trade platform takes three forms, E-Trade Web, Power E-Trade, and E-Trade Pro. And its tradable securities include:

- Stocks

- Bonds

- Mutual funds

- ETFs

- Options

- Futures

E-TRADE remains a popular choice among active traders, not just because of its $0 commissions, but also its discounted commission system for options trades.

But what makes it the ultimate choice is its intense research and analysis tools. These tools include its market commentary, and reports from third-party sites like Thomson Reuters, Moody’s, and others.

Its mobile platform replicates all those features to facilitate smooth trading, and has itself more than 100 technical studies to help you analyze the market.

It goes without mentioning that E-Trade has been acquired by Morgan Stanley and will be operating as a separate unit. However, the deal has not been finalized.

All said, E-Trade performs remarkably well on tools, resources, trading securities, innovation, and costs. It is exceptional, too, on customer service since you can reach out to the support staff any time via phone, email and chat, or in-person service at its 30 local branches. But there’s a tiny shed of a grey area on its fine print. It is not clear on account minimum, and how to close the account, yet this is essential information.

Pros & Cons

Pros

- It’s a top choice for both mobile and options trading

- Has excellent content for learners

- Has a large investment selection

Cons

- The website may be challenging to navigate for beginners

- Lack of transparency on its account minimum

5. Fidelity – Best for Research & Analysis

If you need more than just a trading platform, a platform that helps you make smart market decisions, you can’t look further than Fidelity. The website has a dedicated team of experts who ensure you got every tool you need for your market activities. And you are wrong if you thought you would spend a fortune on it. It is commission-free for online US stock, ETF, and options trades. Some just call it the decision tech. Well, it deserves it, here is why!

If you need more than just a trading platform, a platform that helps you make smart market decisions, you can’t look further than Fidelity. The website has a dedicated team of experts who ensure you got every tool you need for your market activities. And you are wrong if you thought you would spend a fortune on it. It is commission-free for online US stock, ETF, and options trades. Some just call it the decision tech. Well, it deserves it, here is why!

Fidelity day-trading features are packed in Active Trader Pro, while Wealth-Lab Pro is your historical library, with two decades of data. It includes quality reports by 20 providers including, Thomson Reuters, Recognia, McLean Capital Management, and Ned Davis, among others. Investors can compare and contracts report summaries for each stock quote.

As already mentioned, Fidelity is very transparent. It charges only $0.65 per options contract. Moreover, this is where it beats even the industry’s best – TD Ameritrade. Its broker-assisted trades are much cheaper, merely $32.95 to its rivals $44.99.

Fidelity’s web functionality is accompanied by a customizable desktop app – Active Trader Pro. If you want access to Active Trader Pro, you must put at least 36 trades over a 12-month period. You can as well reach out to support for access.

Other complementary services include sensational tools for retirement and casual investors, such as retirement calculators, and helping you compare Roth IRA vs. traditional IRA. You can also check up your budget and exploit its interactive estate planner.

Summed Stock quotes consolidate the platform’s position as the decision tech. Well, what else would you call a platform that accurately provides you with weighted ratings from independent research providers?

Pros and Cons

- Fidelity delivers a five-star rating for both ease of use and a plethora of educational resources.

- Unmatches research tools with quotes and top suggestions running through a screener.

- Great web trading platform for both active trading and investors.

Note: Some trading platforms are specifically tailored for specific securities, such as stocks, currencies,bonds, options, or futures markets.

How to Pick Trading Platform

When most traders concentrate on the fees and costs when choosing a platform, picking the best one goes beyond the obvious. You should focus more on the value than what you pay for it. To ascertain value, you look at the features like research tools, market maker depth charts, and other decision-making tools.

Here is a run-down of the factors you should consider when picking a platform:

- Security – Includes regulation and the platform’s network security.

- Costs – subscription, transaction, and trading fees, if any.

- How you deposit and withdraw funds.

- User-friendliness

- They traded securities, such as stocks, ETFs, Bonds, and much more.

- Platform analytical tools

- Research

- Customer Service

- Mobile Trading

- Education – Does the platform provide learning materials?

Conclusion

There are so many excellent trading platforms that traders are spoilt of choice. Even so, you must consider many things before choosing the best platform to use, and that also rounds down to whether you want to trade or invest, and you are a beginner or a professional. Other factors include the types of assets that are interested in because not all platforms provide every asset.

Our guide here has elaborately covered all there is about trading platforms and helps you make a sound decision. If you want to start trading, just pick a platform, and enjoy all the benefits that come with buying and selling securities online. So, among the top five, which one would you pick?

FAQs

What is day trading?

Day trading is buy-and-sell-trades. It is exploiting the short-term fluctuations in the price of a security for a profit. For this to work, you buy the assets and hold them for a few seconds or minutes. It is different from long-term investment where you buy and maintain security for months before selling.

Do I need skills to be a day trader?

Yes! You need to learn how to predict the price direction using the various data and new extended to you by these trading platforms. As a beginner, you need to learn this and the underlying techniques of pulling this through. That's why trading platforms are resourceful to help you learn. You can always try with a demo account until you are ready so as not to lose money.

How much can I make per day as a day trader?

Well, what you make depends on your skills, frequency of trade, how much you spend, and your risk appetite. As usual, the unwritten law of investment applies – the higher the risk, the greater the return.

Can one make a living day trading?

Yes! Nonetheless, making a living day trading, you must have the needed skills and in-depth knowledge of the market. However, most studies show traders lose money in the long run. Still, smart traders make a living out of it and have been doing for years.