Sometimes months appear longer than they are, especially when you run out of money several days to your next paycheck. Well, that’s when you can consider asking for a slight push on the back – a payday loan. And with everything linked to our phones, payday loan apps come in handy.

Payday loan apps are quick and easy to access. They can be a relief between paychecks. With about 23,000 payday lenders— almost twice the number of McDonald’s restaurants in the country — you would assume that getting the right loan is an easy exercise. Surprisingly, that’s not the case. It’s easy to fall prey to predatory lenders than it is to default on your loan.

Thanks to our expertise in this industry, we have reviewed several such apps and identified the most suitable options that can help you between one payday and the next.

Contents

- 1 How Payday Advance Apps Work

- 2 Top Payday Loan Apps

- 2.1 1. PayActiv – Best of Highest Manageable Loan Limit

- 2.2 2. CashNetUSA – Best for Outstanding Customer Service

- 2.3 3. LendUp App – Best for People with Bad Credit

- 2.4 4. Speedy Cash – Best for a variety of Payday Loans

- 2.5 5. ACE Cash Express Mobile Loans – Best for Building your Credit

- 2.6 6. MoneyLion – Best for Quick Payouts

- 2.7 7. Brigit Loan App – Best for Flexibility

- 2.8 8. Earnin – Best for Interest –free Payday Loans

- 3 Payday Loans and Their Limits

- 4 Final Word

- 5 FAQs

How Payday Advance Apps Work

A payday loan is a short-term loan, often linked to your next paycheck that a lender extends to you with a promise you’ll pay it back within a few days. Sometimes we refer to them as cash advances since it gives you access to your paycheck a few days early.

These payday loan apps work in different ways. Some link to your week work log, and if you need a loan, the highest amount it awards directly correlates with the hours you have already accomplished. The app is also linked to your checking account, so it directly deposits the requested amount.

Some payday lenders allow you to stagger the repayments across multiple paychecks, which is a good thing. You don’t put too much pressure on your monthly budget. On the flip side, you pay more in interest.

If you choose to pay the loan once, especially if it was a fairly substantial amount, you may be left with less than enough to settle everything. Of course, in the end, you take another loan. If you don’t check this trend, you could quickly end up living in debts.

These payday loan apps require that you have a checking account, which makes it easier for the lender to collect the repayments automatically. In most cases, the lender will automatically debit your account when your payment arrives. Let’s say you borrow $100; it credits it to your account. When your next paycheck arrives, the lender automatically deducts the amount plus the costs and interest.

However, you can always pay the loan early to prevent the auto-debits. You can also negotiate with your lender for alternative repayment methods.

Note: Payday loans are expensive forms of credit that don’t fix your financial problems. You should only use it as a stopgap measure and an option of last resort.

Top Payday Loan Apps

Most payday loan apps come with many additional features besides extending you a quick short-term unsecured loan. These features determine which apps best suit your case.

Here are some of the best payday loan apps:

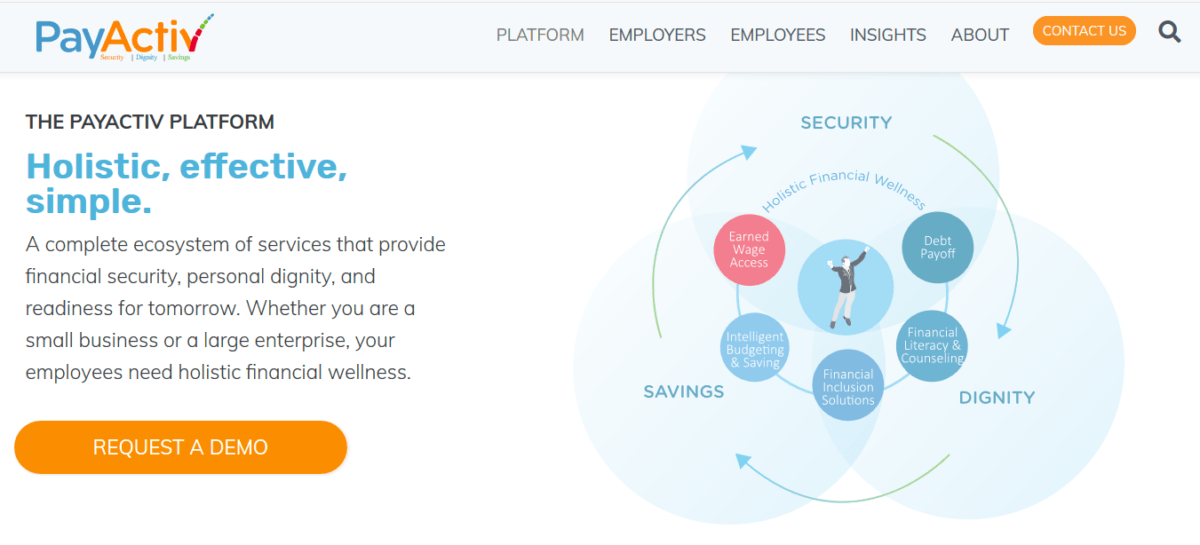

1. PayActiv – Best of Highest Manageable Loan Limit

PayActiv app lends you up to 50% of your total earned wages at a monthly preset fee of up to $5. The principal amount can be way higher than what you can get elsewhere. The amount no matter how high is manageable because it is just 50% of your total earnings that month.

PayActiv app lends you up to 50% of your total earned wages at a monthly preset fee of up to $5. The principal amount can be way higher than what you can get elsewhere. The amount no matter how high is manageable because it is just 50% of your total earnings that month.

The app is not your typical payday loan provider but a holistic financial technology platform. For it to work, it requires the collaboration of your employer as well. It will need all timesheets and payroll information, which only your employer is in a position to provide. Some companies, such as Uber and Walmart, are already in partnership with the lender, to offer cash advances to its employees whenever they need it.

You may ask, why we included PayActiv here. Well, as much as it is not marketed as a payday loan app, but it is one. Look, no matter how much you borrow, you settle the entire amount with your next paycheck. Isn’t that what payday loans all about?

PayActiv also helps users streamline their spending habits by incorporating finance management tools.

Pros and Cons

Pros

- It allows instant access to up to 50% of wages.

- It includes other financial management features like bill pay, savings, & budgeting tools.

- Low manageable fees

Cons

- You can only enjoy the service if your employer subscribes to the service, though not every employer is eligible.

- You could easily misuse the app, especially if you have a spending problem.

- It takes time to update the payroll information, so you may not qualify for the amount you expected.

2. CashNetUSA – Best for Outstanding Customer Service

CashNetUSA is among the top-rated apps on both iOS and Android platforms. The lender is part of the publicly trading blue-chip company, Enova International group, which also owns other Payday loan lenders like Headway Capital, NetCredit, On Stride Financial, and QuickQuid.

CashNetUSA is among the top-rated apps on both iOS and Android platforms. The lender is part of the publicly trading blue-chip company, Enova International group, which also owns other Payday loan lenders like Headway Capital, NetCredit, On Stride Financial, and QuickQuid.

The lender allows you to borrow from $100 to $3,000, depending on your state of residence. And you don’t have to worry about your credit score because it accepts a score as low as 300.

You must, however, note that like all payday loans, CashNetUSA charges an extremely high APR. Its rate ranges between 89% and 1,140% APR. But you can save on the cost by paying the money back as quickly as two weeks, even though the lender can give you up to 24 weeks.

Pros and Cons

Pros

- Get instant access to the funds you need.

- The app gives you a detailed loan status and balance.

- Integrated calendar reminders for the loan due dates.

Cons

- Not available in all states

- Interest varies state-by-state

- May charge a loan origination fee

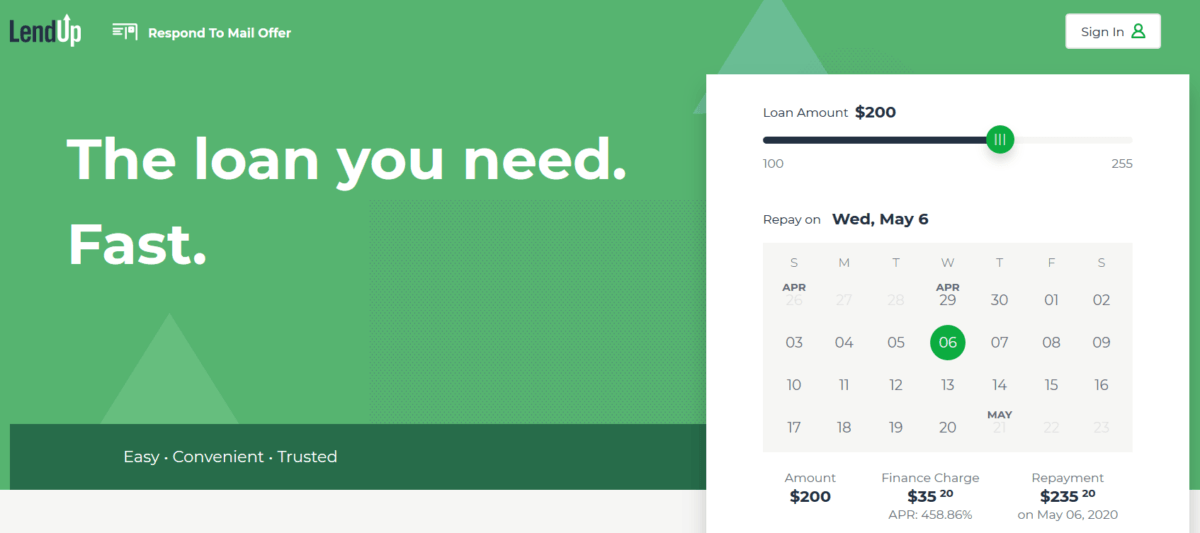

3. LendUp App – Best for People with Bad Credit

LendUp app provides an easy to apply payday loan of between $100 and $250. All you have to do is create your account and provide your details, including your social security number and driver’s license number.

LendUp app provides an easy to apply payday loan of between $100 and $250. All you have to do is create your account and provide your details, including your social security number and driver’s license number.

As a direct lender, LendUp approves and funds the loans locally and doesn’t share your information with other lenders. What’s more, it targets people with bad credit.

Even so, the interest rates available to you depend on factors like your credit score, the amount you borrow, and how long you take to settle it. But it can often exceed 1,000% APR.

Pros and Cons

Pros

- Available to borrowers with bad credit

- Manageable loans of up to $250 for first-time applicants

- No prepayment penalties

Cons

- Very high APR

- $250 is a pretty low loan limit

- Only available in a few states

4. Speedy Cash – Best for a variety of Payday Loans

Speedy Cash provides various types of short-term loans, among them payday loans of between $100 and $1,500. Read the full review here. The Speedy Cash app first requires you to register, which you do by tapping Apply Now.

Speedy Cash provides various types of short-term loans, among them payday loans of between $100 and $1,500. Read the full review here. The Speedy Cash app first requires you to register, which you do by tapping Apply Now.

But the app has a relatively simple registration process and returns several benefits. You get notifications, reminders, and manage your loan at the palm of your hands. You can as well request for an adjusted loan due date. Also, the lender has local stores, which you can quickly locate using the store locator integrated into the app.

Speedy Cash also offers installment loans, check cashing services, title loans, and many other short term loans. Since you have to pay the payday loan within 7 to 14 days, you easily restructure it into an installment loan that you can easily pay in manageable equal monthly installments.

Its annual rates are about 459.90%, subject to your state of residence.

Pros and Cons

Pros

- Has a variety of short-term loans

- Quick processing and disbursement of funds

- Quality customer support.

Cons

- High-interest rate

- May not be available in your state

5. ACE Cash Express Mobile Loans – Best for Building your Credit

With hundreds of stores spread across different states, ACE Cash Express Mobile Loans provides you with quick access to funds that it later automatically deducts from your next pay.

With hundreds of stores spread across different states, ACE Cash Express Mobile Loans provides you with quick access to funds that it later automatically deducts from your next pay.

The app not only offers payday loans but also works different stores where it allows you to get the items you need, but it pays on your behalf.

Whether you qualify for the loan or not will depend on your residential state and the respective regulations. But it primarily targets borrowers with poor or no rating.

Ace Cash App is one of the few payday loans that help you build your credit history. Besides, you can change your mind within 72 hours of taking the loan and return the funds without suffering any consequence.

Pros and Cons

Pros

- An in-app loan application is straightforward and fast.

- No early repayment fees

- It offers credit-builder loans

Con

- It becomes a third-party lender in some states, but it is not outright about it.

- It may not be available in your state

- Costly loans

Note: Many payday loan alternatives will save you spending too much money on interest on short-term loans. We include some on this list.

6. MoneyLion – Best for Quick Payouts

MoneyLion is a mobile loan lender with different loan products, among them Instacash cash advances. This instant cash plays the same role as a payday loan – it gives you access to your next paycheck a little early. But one thing that stands out here is that MoneyLion charges no interest. The loan limit, though, is subject to your expected income up. You cannot, however, get more than $250.

MoneyLion is a mobile loan lender with different loan products, among them Instacash cash advances. This instant cash plays the same role as a payday loan – it gives you access to your next paycheck a little early. But one thing that stands out here is that MoneyLion charges no interest. The loan limit, though, is subject to your expected income up. You cannot, however, get more than $250.

As its name suggests, MoneyLion Instacash is available to you within minutes of application. It is not an entirely free service, but a bonus for operating a direct deposit checking account with MoneyLion.

MoneyLion also has other loan products, including up to $50,000 personal loan.

Pros and Cons

Pros

- Instant access to cash

- No credit checks the payday loan alternative

- No fees for the InstantCash service

Cons

- You must have a MoneyLion direct deposit checking account

- Not available in some states

7. Brigit Loan App – Best for Flexibility

Some people will quickly dismiss the Brigit App as a payday loan. But these loans come disguised in all forms and shapes. The Brigit, for instance, does not charge interest, but instead a monthly membership fee of $9.99. Also, it requires you to earn at least $1,500 a month. But it still serves the same purpose as payday loans, doesn’t it?

Some people will quickly dismiss the Brigit App as a payday loan. But these loans come disguised in all forms and shapes. The Brigit, for instance, does not charge interest, but instead a monthly membership fee of $9.99. Also, it requires you to earn at least $1,500 a month. But it still serves the same purpose as payday loans, doesn’t it?

If you meet the quoted conditions, you can put in a request for a cash advance of up to $250 and have it within two days. Yes, two days! It is not as fast as the other apps we have already discussed.

Well, it may not be the best option, but it has free due date extensions and automatic cash advances whenever your account runs low on funds. So, with the app, you say goodbye to the hefty bank overdraft fees.

While it is fairly new, we trust it will improve over the years, given the big names behind it. Such companies include Amazon, Credit Suisse, Deutsche Bank, Expedia, Two Sigma, and more.

Pros and Cons:

Pros

- Interest-free cash advances

- No late payment penalties.

- Avoids bank overdrafts

Cons

- The recurring $9.99 monthly subscription

- Slow loan request processing.

- Prohibitive eligibility criteria.

8. Earnin – Best for Interest –free Payday Loans

If you like Brigit, you like Earnin even more. Unlike its counterpart, Earnin does not charge you any monthly subscription but requests you to tip them after every transaction. Also, you have a reasonably high loan limit each day. You can borrow $100 per day or up to $500 per your pay period.

If you like Brigit, you like Earnin even more. Unlike its counterpart, Earnin does not charge you any monthly subscription but requests you to tip them after every transaction. Also, you have a reasonably high loan limit each day. You can borrow $100 per day or up to $500 per your pay period.

Now makes it a payday loan is the fact that you can only borrow what you have already earned. So, if you are paid $16 per hour, and you have worked for 20 hours, you can only borrow up to $320, no more.

Nonetheless, Earnin has a faster turnaround, disbursing your funds in just a few minutes through its Lightning Speed program. Also, it prevents bank overdrafts by topping up your account to meet the required payments.

Pros and Cons

Pros

- Up to $500 per pay period cash advance

- No membership fees but a tipping system

- Overdraft protection.

Cons

- You can only borrow for the amount already earned.

- You must provide a work schedule.

Payday Loans and Their Limits

Yes, if you need quick help to cover an emergency or an unexpected expense, payday loan apps will come to your aid. Some also help you stay avoid bank overdrafts or the late payment fees, keeping your costs within your budget.

A payday loan seems to be a quick way out of small-time financial problems, but they can equally disorient your finances. In most cases, the best way to address your financial shortfalls is to get a quality credit facility like a personal loan as it offers a much lower interest and more manageable payments than a payday loan.

Also, personal loans pay attention to your financial wellbeing by performing credit and affordability checks before approval. Unlike payday loans, repayment of a personal loan goes into your credit history, helping you repair your credit ranking so that you can qualify for better rates next time.

If you can’t qualify for a reasonable interest rate, you can go for secure loans, which require a form of collateral like a car or cash home equity. With a score, you may qualify for a rate as low as 5% APR for a personal loan, which could help you solve your financial distress without much pressure.

Underline this; payday loans don’t qualify as quality solutions to deep financial problems. So you may want to find a side hustle to increase your income if you constantly find yourself needing such help.

Final Word

There are so many ways to get help when you are stuck financially. You can often ask friends or family or even go to the bank. But let’s agree, none provides financial help as quickly as any of these loan applications. They are fast and convenient because it is a few clicks away. Just open an app, submit your request, and boom, you have the money. There you have them – the best payday loan apps, what’s your favorite, and why?

FAQs

Do cash advance loans similar to payday loans?

Yes! There is an extremely thin line between a cash advance and a payday loan. Maybe it is just the name. Cash advances accrue daily interest the same as payday loans, and they are linked to your next paycheck. Both must be paid wholesomely on your next payday.

What other services do payday loan apps offer?

Some payday loan apps also double as budgeting tools that help you track and manage your finances and help you build up your reserve fund. Interestingly, some even help you to earn cash-back rewards through side gigs to stop relying on such cash advances to cover those unplanned expenses.

Will using a payday loan app build my credit?

No! Most payday loan apps don’t list their loans at the relevant credit agencies. However, if you don’t pay the loan back in time, it can cause you a lot of problems and adversely injure your already ailing credit score.

Can I install more than one payday loan app on my phone?

Yes. You can hold multiple payday loans from different providers. Even so, it is advisable to consolidate the loans into one big quality loan. Otherwise, you will spend unnecessarily on costs and interest. Moreover, payday loans should be a stopgap measure.